Why POS Software Is Becoming Critical Financial Infrastructure for EMI Banks and Payment Providers

A Hard Truth for Modern Payments

Most EMI banks and payment institutions are still underwriting and servicing merchants using delayed, abstracted, and incomplete financial data. By the time accounting reports are prepared and reviewed, the reality of the business has already changed. Risk has shifted, cash flow has moved, and opportunities—both for growth and intervention—have already been missed.

The problem is not payments. The problem is visibility.

And that visibility starts at the POS layer.

Who This Article Is For

This article is written for EMI banks and licensed payment institutions operating across multiple jurisdictions that are seeking:

-

Better merchant visibility and risk understanding

-

Lower merchant churn and higher lifetime value

-

Smarter lending and embedded finance models

-

Stronger, more defensible merchant relationships

POS Is No Longer Just Retail Software

For decades, point-of-sale (POS) systems were treated as simple checkout tools. In reality, POS software has become one of the most critical layers of financial infrastructure in modern commerce.

Every retail and hospitality business runs its economic life through its POS system:

-

Sales and refunds

-

Pricing, discounts, and taxes

-

Cash flow and settlement timing

-

Staff activity and productivity

-

Inventory movement and stock velocity

Yet most payment providers still rely on backward-looking accounting data rather than real-time operational data generated at the POS.

The Hidden Risk: Legacy POS Systems Across Global Markets

Across global retail and hospitality markets, many merchants still operate on legacy POS systems that:

-

Run on a single terminal

-

Lack real-time cloud synchronisation

-

Offer no web dashboard for owners or finance teams

-

Provide no mobile apps for business monitoring

-

Expose no structured API access to business data

These systems were never designed to support modern financial services such as dynamic credit assessment, revenue-based lending, or real-time risk monitoring.

Real-Time POS Data for Underwriting and Risk Decisions

HowToPay POS was built as an API-first, real-time business data platform, not just a payment interface.

Through structured APIs, EMI banks can access permissioned, live operational data including:

-

Real-time gross and net sales

-

Transaction-level item detail

-

Payment method breakdowns

-

Daily cash flow patterns

-

Refunds, voids, and anomalies

-

Staff and shift performance indicators

This enables:

-

Faster and more accurate underwriting

-

Continuous merchant health monitoring

-

Early detection of risk or distress

-

More competitive and fair pricing of financial products

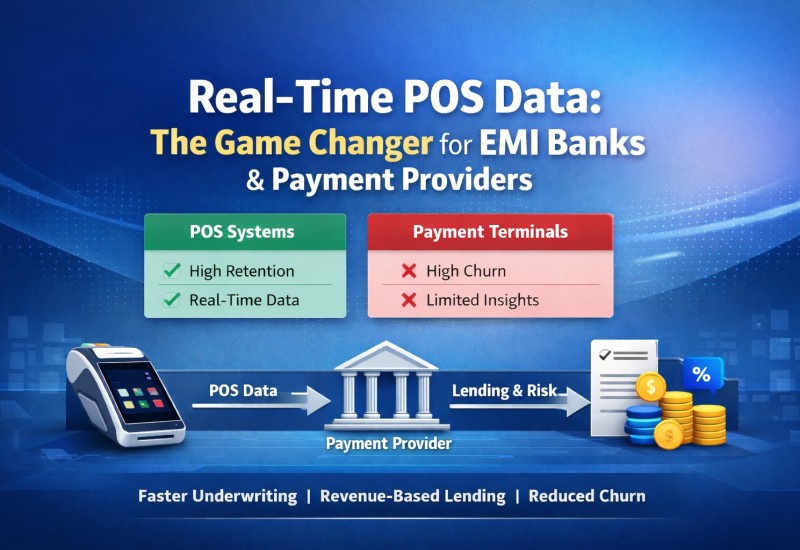

POS vs Payment Terminals: Why Stickiness Matters

Payment terminals are commodities. Merchants regularly switch providers based on small pricing changes or promotional offers.

POS systems are fundamentally different.

The POS is the operational core of a business. It controls:

-

Menus, products, and pricing logic

-

Staff access, shifts, and permissions

-

Inventory and supplier workflows

-

Business reporting history

Once embedded, switching POS systems introduces operational risk, retraining costs, and potential downtime. As a result, POS platforms are inherently sticky, delivering significantly lower churn than standalone payment terminals.

For EMI banks, integrating at the POS layer rather than the terminal layer results in:

-

Longer merchant lifecycles

-

Higher lifetime value (LTV)

-

Reduced price-based churn

-

Stronger competitive defensibility

How Merchant Data Flows: POS → Payment Provider → Lending & Risk

HowToPay POS enables a clear and continuous data flow:

-

Transactions occur at the POS in real time

-

Operational and financial data is normalised and structured

-

Payment providers receive live visibility via APIs

-

Lending, risk, and settlement decisions adapt dynamically

This replaces static, historical reporting with living financial insight.

Real-Time Lending That Drives Acquisition and Retention

Access to real-time POS data allows EMI banks to offer:

-

Revenue-based lending aligned to actual performance

-

Faster credit approvals for growing merchants

-

Adaptive limits that scale with the business

These capabilities materially improve merchant acquisition while significantly reducing churn. Merchants are far less likely to leave a provider that understands their business and grows alongside them.

Built for Global, Multi-Jurisdiction Operations

HowToPay POS is designed for EMI banks operating across multiple countries and regulatory environments:

-

Cloud-native architecture

-

Cross-platform Flutter applications (Windows, Android, macOS, Web)

-

Consistent data models across devices and regions

-

API-driven integration for financial institutions

This allows payment providers to deploy a unified strategy across markets while maintaining local compliance.

POS as a Strategic Infrastructure Partnership

HowToPay POS is not positioned as a vendor product. It is designed as long-term financial infrastructure for EMI banks and payment institutions.

By embedding at the POS layer, providers move beyond transaction pricing and become integral to the merchant’s daily operations, decision-making, and growth.

Partner With HowToPay POS

For EMI banks seeking deeper merchant relationships, better risk insight, and lower churn, POS integration is no longer optional.

HowToPay POS offers a strategic entry point into real-time merchant intelligence and long-term infrastructure partnerships.

HowToPay POS is not where payments end. It is where financial intelligence begins.

Contact for Strategic Partnerships

EMI banks and licensed payment institutions interested in strategic POS integration, data partnerships, or embedded finance collaboration are invited to make direct contact.

Mr Cameron McKean

Chief Executive Officer

Confidia Limited

Email: [email protected]